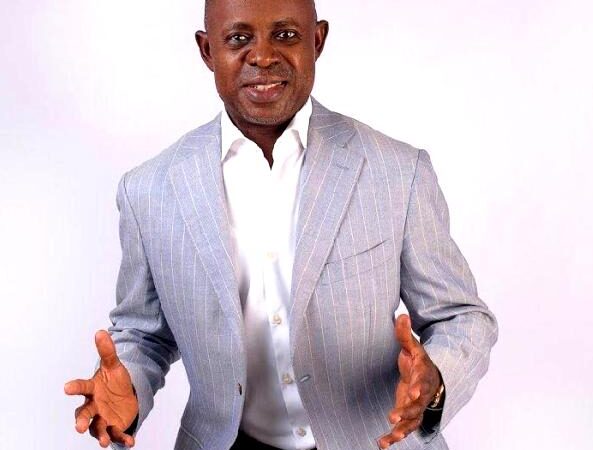

Importance Of Aviation Industry Performance Review, By Aisuebeogun

The Co-Chairman of NIGAV Award Committee, Dr. Richard Aisuebeogun says a periodic performance review of Nigeria’s aviation industry “allows us to assess how effectively the industry’s KPIs, established in the past year under review, have been met in terms of action plans and implementations.

The absence of review hinders development and progress. The aviation industry is structured to operate under a long-term plan, necessitating ongoing review, reassessment, updating, and implementation. This continuous cycle maintains efficiency and safety within the aviation ecosystem.”

Presenting an Aviation Annual Report & Outlook at the 14th Nigeria Aviation (NIGAV) Awards and Ministerial Dinner held last Friday at the NIGAV Centre, Lagos, Aisuebeogun said “although the economic landscape of 2024 has been volatile with the soaring cost of living and the high cost of air transportation, the industry in Nigeria has generally managed to grow with an increasing fleet and more airports coming on board. The 2024 review will look at performance in strategic areas from administration, regulation, policy, programmes, projects, market profile, and discussions that trailed the industry in the outgoing years and offer an empirical projection into 2025.”

On growth in aircraft acquisition, he said “though growth for the airline began in 2023, domestic airlines are modernising their fleets with an increase in new aircraft acquisitions. This includes Air Peace’s acquisition of new aircraft for its domestic and regional route operations, followed by Ibom Air’s firm order of ten (10) A220-300s in line with its strategic expansion plan. Additionally, Overland Airways placed a firm order for three E175s and took delivery of two of the aircraft types. With the Federal Government meeting the conditions of the Cape Town Convention (CTC), which has removed Nigeria from the blacklist of aircraft leasing risk (ALR) countries, the door is now open for lucrative and sustained long-term lower-cost financing of aircraft under dry lease agreements. This is a game changer for the industry, assuring access to international financiers with long-term credit facilities at a single interest rate.”

Reviewing routes expansion and emerging new airports, He said: “One can say that Nigeria’s passenger traffic utilisation is very low compared to our population and the dynamic nature of our people who predominately trade. The aviation sector is not relenting but proactively planning for what may become a sudden spike in demand. In 2024, see such action in place with the emerging new airport waiting for airlines and passengers.

Airlines like United Nigeria, Value Jet, Air Peace, Ibom Air, Green Africa, and Overland expanded their domestic networks. Interestingly, Air Peace, Ibom Air, and Overland Airways pushed head-ward in Regional Operations. While Air Peace began operations on the LOS-Tel Aviv-LOS and LOS-Jeddah-LOS routes, Ibom Air added capacity to the very popular LOS-ACC-LOS route in November 2023 and has continued to maintain in 2024 and Overland on the LOS-FNA-LOS-BJL-LOS, and Value Jet added Jos on its route development.

It is significant to note here that a new strategy of airport and airline relationships began to evolve in 2024 to allow more airports to have servicing airlines; such a relationship involves the state government acquiring aircraft for efficient operators to run and keep the route active. The Enugu State government and the State airport are examples of this emerging route development initiative. This has also been noticed in sub-regional flights with Xejet, a Nigerian airline set tooperate the Sierra Leone State Airline.

More airlines have been granted designation approval on the Lagos-London route. The federal government, through the Ministry of Aviation, also approves United Nigeria Airlines’ flights to six countries under its active BASA.”

Aisuebeogun said “the extensive research on advanced air mobility and AI automation will position it as the biggest innovation disruptor in air transport over the next ten years.”

On infrastructure projects, he said “infrastructure has continued to present significant challenges. The ongoing recession and severe devaluation of the naira have resulted in only a few projects being delivered, with last year’s budget performance remaining about the same as the previous year at 40%, alongside the delayed implementation of numerous projects.

In 2024, the dilemma of a 50% statutory deduction from allocations to aviation agencies persisted, leading to a funding crisis and ongoing exploration of airport concessioning options.”

He noted that the industry has continued to showcase a success story such as Runway 18R of Murtala Muhammed Airport Ikeja, which has recently installed a long-awaited Airfield Lighting System, restoring nighttime operations for the runway. Unfortunately, this was short-lived, as reports indicated that the AFL cables were vandalised and stolen; Improvements in airspace navigation management services by NAMA which have been made with the installation of radar equipment across all airports in the country, capable of capturing low-level flying aircraft, especially in the Niger Delta region. Most importantly, the Air Traffic Management systems have been upgraded from Terrestrial to Satellite-Based Navigation systems; New capital injections into projects from ground handling companies like Skyway Aviation and NahcoAviance that have been observed as they expand their operations and upgrade their equipment capacity and Ibom Air’s expansion of terminal facilities and the near completion of ultra-modern, state-of-the-art MRO facilities, which are worthy of note and commendation.

Aisuebeogun said 2024 presented the industry with challenges of one helicopter air crash, issues and service quality.

“The year presented the industry, notably the Air transport and Air Travel Passengers, with challenges that were quite teething. The Airlines were confronted with the high cost of Jet-A1, low passenger traffic, non-availability of forex sorely needed for maintenance, and the dwindling availability of highly skilled technical, professional, and managerial manpower. Also, the increasing resort to wet leases with their high running costs under a persisting circumstance that imposed that type of lease against the cheaper Dry Lease option remains problematic until today.”

“Passengers continue to face increasingly high airfares on domestic, regional, and international routes. Unacceptable incidents of rights abuse and poor service quality by airlines, including flight delays, were reported. In the year under review, there were some non-fatal incidents involving three scheduled operators.”

His forecast for 2025 performance is that “the year 2025 will be shaped by the implementation of policies that were meticulously reviewed in 2024; several key issues will influence the aviation industry during this year. A crucial factor will be the extent to which the Nigerian government facilitates aircraft acquisition and access to credit from international financiers for domestic airlines. Although this initiative began with the Cape Town Convention (CTC) agreement, more capable airline operators will need to leverage the opportunities created by this administration.

Additionally, in 2025, the federal government is expected to officially commence airport concessions, inviting the private sector to invest in airport infrastructure. This will enhance airport facilities, enable Nigeria to develop state-of-the-art airports, and improve passenger experience. With the growing automation of passenger processes and the collaborative efforts between the Ministry of Aviation and the Ministry of Interior Affairs, more efficient immigration processing is anticipated in 2025.

There has been a strong push to address the country’s local aircraft maintenance gap. It is hoped that Nigeria will establish a significant maintenance, repair, and overhaul (MRO) operation and support exiting ones like Areo MRO to expand to help reduce the demand for foreign exchange by commercial airlines that currently conduct substantial maintenance overseas.

It is anticipated that the issue surrounding Nigeria Air and the necessity for a National Carrier will be resolved by 2025, given the significant international air travel market in Nigeria with over 80 Bilateral Air Service Agreements (BASAs). This is part of a strategic effort to alleviate the struggles faced by Nigeria’s international passengers, who often have to take longer and more circuitous routes to reach their destinations. It is believed that Nigerian Domestic Airlines, which currently operate regional flights, will become more assertive and dominant within West and Central Africa in 2024.

Nigerian air cargo operations are experiencing a rise in cargo inflow due to improvements in international e-commerce gateways to Nigeria. This has generated significant traffic in small and medium-sized enterprise (SME) cargo operations between the airports and distribution centers across major Nigerian cities. In 2025, the government is expected to explore these emerging opportunities and refine operations to mitigate the risk of drug trafficking through aviation.

Aviation industry observers are optimistic that 2025 will further advance Tinubu’s aviation policy, which is rooted in enhancing Nigerian airlines, developing airport infrastructure, and strengthening regulations that govern the aviation industry to achieve safer, more efficient airline operations, increased profitability, and the creation of more jobs.”

He therefore recommended that “consistency in policy implementation is essential for ongoing growth. Therefore, this administration must harmonize the five-point agenda of the current aviation administration with the previous aviation roadmap. A review of potential obstacles to the roadmap is necessary to create a pathway for everyone to engage in its implementation.

The administration should prioritize developing an updated airport master plan and begin implementing one that guides airport development nationwide.

The current Nigerian airline business climate is positively competitive. However, sustained growth and stability in 2024 will require government intervention and control of the declining foreign exchange market or even providing aviation businesses with special access to the crucial foreign exchange.

The Federal Ministry of Aviation must engage in discussions and subsequently negotiate with the Dangote refinery or any other private refinery initiatives in the country to swiftly address the availability of Jet A1 (Aviation Turbine Kerosene, ATK) fuel and prevent crises for the airlines.

Institutional funding for aviation has been significantly low. The volatile nature of the market makes commercial bank funding difficult to obtain and unattractive due to the high cost of capital. It is hoped that the complete capitalization of Nigeria’s aviation leasing company will help airline owners attract the necessary capital for fleet enhancement. Nonetheless, the industry must consider various funding options for aviation projects by establishing a structured funding instrument, such as a sector bank that can ensure the financial stability of the industry.

Aviation in Nigeria remains the safest form of transportation and the fastest means to facilitate economic growth. The industry is projected to face challenges in 2025 due to Nigeria’s low spending power amid the current cost-of-living crisis. However, if the government directly supports the industry, it can alter the downward trend of the economy by providing the interstate and international mobility needed to drive high-earning services.

This support can take the form of tax incentives, waivers, and a consistent policy to improve air transportation infrastructure by lowering short-term expectations from aviation and removing aviation from the TSA remittance.”